When it comes to safeguarding your vehicle, understanding State Farm comprehensive coverage is crucial for any car owner. Comprehensive coverage plays a vital role in protecting your car from unforeseen events that are not related to collisions. Whether it's theft, natural disasters, or damage caused by animals, this insurance policy ensures you're prepared for the unexpected. In this article, we'll explore everything you need to know about State Farm comprehensive coverage to help you make informed decisions about your car insurance needs.

Car insurance can be a complex topic, but it's essential to grasp the basics. Comprehensive coverage offered by State Farm is one of the most important elements of a well-rounded car insurance policy. It provides financial protection beyond just accidents, giving you peace of mind in the face of life's unpredictable events.

As you continue reading, you'll discover detailed information about the benefits, limitations, and costs associated with State Farm comprehensive coverage. By the end of this guide, you'll be equipped with the knowledge to decide whether this coverage is right for you and how to maximize its value.

Read also:Break Up Of Catriona Gray And Sam Milby What Really Happened

What is State Farm Comprehensive Coverage?

State Farm comprehensive coverage is a type of insurance policy designed to cover damages to your vehicle that result from non-collision incidents. Unlike collision coverage, which addresses damages caused by accidents, comprehensive coverage protects your car from a wide range of other risks. These include:

- Damage caused by animals

- Theft of the vehicle

- Vandalism

- Natural disasters such as floods, hurricanes, or earthquakes

- Falling objects

- Fire

This type of coverage is optional but highly recommended, especially for drivers who live in areas prone to natural disasters or where the risk of theft is high. By opting for State Farm comprehensive coverage, you ensure that your vehicle is protected against a variety of unforeseen circumstances.

Why Choose State Farm Comprehensive Coverage?

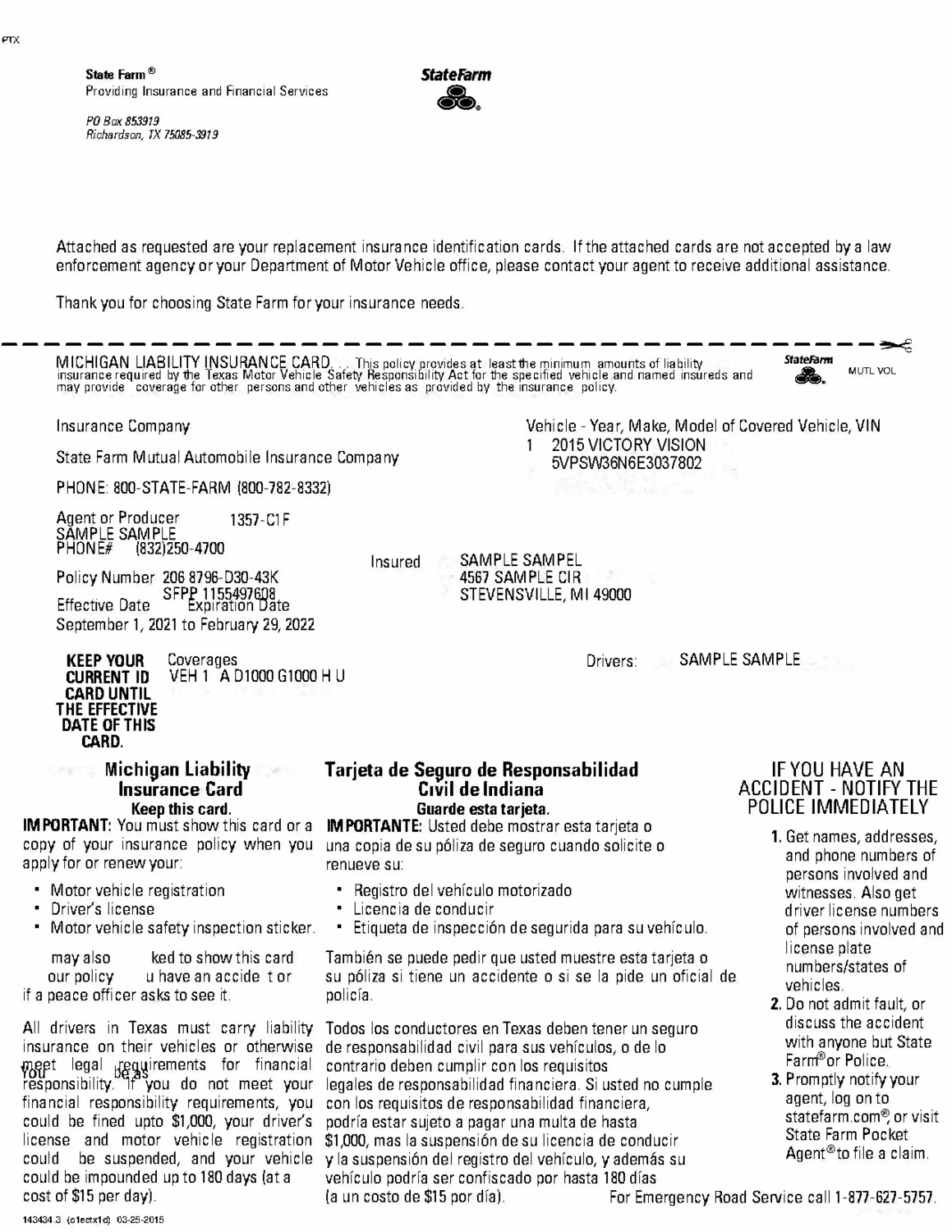

State Farm is one of the largest and most reputable insurance providers in the United States. Choosing State Farm comprehensive coverage offers several advantages:

1. Wide Range of Protection

State Farm's comprehensive coverage protects your vehicle from a broad spectrum of risks, ensuring that you're covered in almost any situation. This extensive protection gives you peace of mind, knowing that your investment is safeguarded.

2. Competitive Pricing

State Farm is known for offering competitive rates while maintaining high-quality service. Their comprehensive coverage is priced fairly, making it accessible to a wide range of customers.

3. Excellent Customer Service

State Farm has a reputation for providing exceptional customer service. Their agents are trained to assist you every step of the way, ensuring that you understand your policy and receive the support you need when filing a claim.

Read also:Mastering Aimbot Code 2024 Unveiling The Secrets Of Precision And Performance

How Does State Farm Comprehensive Coverage Work?

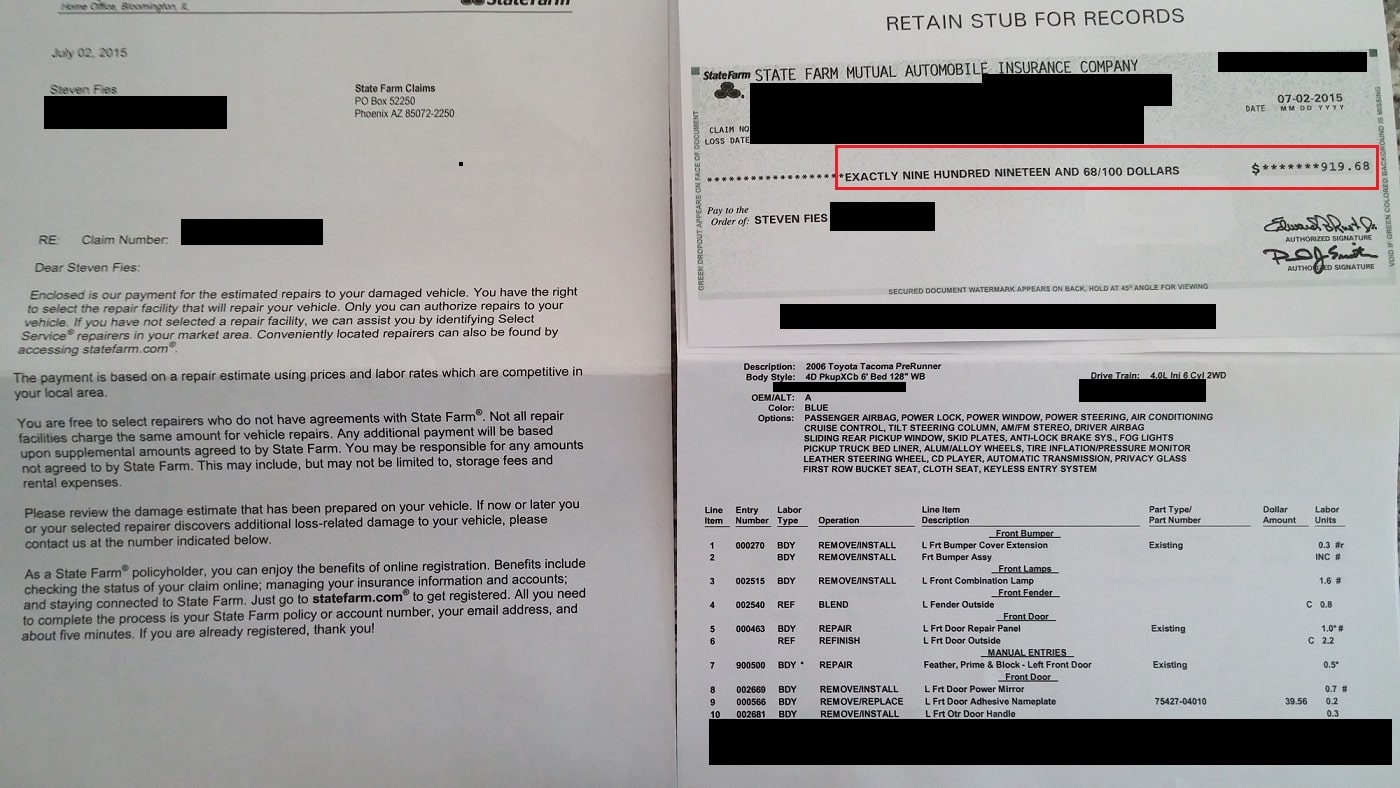

Understanding how State Farm comprehensive coverage works is essential to making the most of your policy. Here's a step-by-step guide:

- Choose the right coverage limits based on your needs and the value of your vehicle.

- Pay your premiums on time to keep your policy active.

- In the event of a claim, contact State Farm immediately to initiate the process.

- Provide necessary documentation, such as police reports or photos of the damage.

- State Farm will assess the damage and determine the compensation amount based on your policy terms.

It's important to note that comprehensive coverage typically comes with a deductible, which is the amount you pay out-of-pocket before State Farm covers the remaining costs.

State Farm Comprehensive Coverage Costs and Factors

The cost of State Farm comprehensive coverage varies depending on several factors. Here are some key elements that influence the price:

1. Vehicle Value

The value of your vehicle directly affects the cost of comprehensive coverage. More expensive cars generally require higher premiums due to their higher replacement costs.

2. Location

Your geographic location plays a significant role. Areas with higher rates of theft or natural disasters may result in higher premiums.

3. Deductible Amount

Choosing a higher deductible can lower your monthly premiums, but it means you'll pay more out-of-pocket if you need to file a claim.

4. Driving History

A clean driving record can lead to lower premiums, as State Farm considers your history when determining risk levels.

State Farm Comprehensive Coverage vs. Collision Coverage

While both comprehensive and collision coverage protect your vehicle, they serve different purposes:

Comprehensive Coverage

As mentioned earlier, comprehensive coverage handles non-collision incidents, such as theft, natural disasters, or animal-related damages.

Collision Coverage

Collision coverage, on the other hand, addresses damages caused by accidents involving other vehicles or objects. It's important to note that these two types of coverage often work together to provide complete protection for your vehicle.

Limitations of State Farm Comprehensive Coverage

While State Farm comprehensive coverage offers extensive protection, it's essential to be aware of its limitations:

- It does not cover damages resulting from accidents involving other vehicles.

- Wear and tear, mechanical failures, or maintenance issues are not covered.

- Damage caused by driving under the influence or reckless behavior may not be covered.

Understanding these limitations helps you manage expectations and make informed decisions about your insurance needs.

How to File a State Farm Comprehensive Coverage Claim

Filing a claim with State Farm is a straightforward process:

- Contact your State Farm agent or call their customer service hotline.

- Provide details about the incident, including any relevant documentation.

- State Farm will assign an adjuster to assess the damage and determine the compensation amount.

- Once approved, you'll receive reimbursement for the covered damages, minus your deductible.

Efficient communication and proper documentation are key to a smooth claims process.

State Farm Comprehensive Coverage and Natural Disasters

Natural disasters can cause significant damage to your vehicle. State Farm comprehensive coverage provides protection against:

1. Floods

Water damage from floods is covered under comprehensive coverage, ensuring your vehicle is protected during heavy rains or flash floods.

2. Hurricanes

In areas prone to hurricanes, State Farm's comprehensive coverage offers peace of mind by covering damages caused by high winds and debris.

3. Earthquakes

Earthquake-related damages to your vehicle are also covered, providing additional security in earthquake-prone regions.

Tips for Maximizing State Farm Comprehensive Coverage

To make the most of your State Farm comprehensive coverage, consider the following tips:

- Review your policy regularly to ensure it meets your current needs.

- Choose a deductible amount that balances affordability and financial protection.

- Keep detailed records of any incidents or claims for future reference.

- Maintain a clean driving record to qualify for lower premiums.

By taking these steps, you can optimize your State Farm comprehensive coverage and enjoy maximum benefits.

State Farm Comprehensive Coverage: Frequently Asked Questions

1. Is comprehensive coverage mandatory?

No, comprehensive coverage is optional. However, it's highly recommended, especially for newer vehicles or those in high-risk areas.

2. Can I add comprehensive coverage to my existing policy?

Yes, you can add comprehensive coverage to your existing policy by contacting your State Farm agent.

3. How long does it take to process a comprehensive claim?

The processing time varies depending on the complexity of the claim, but State Farm strives to handle claims efficiently and promptly.

Conclusion

In conclusion, State Farm comprehensive coverage offers invaluable protection for your vehicle against a wide range of non-collision incidents. By understanding its benefits, limitations, and costs, you can make informed decisions about your insurance needs. Whether you're safeguarding your car from theft, natural disasters, or animal-related damages, State Farm's comprehensive coverage provides peace of mind and financial security.

We encourage you to review your current policy and consult with a State Farm agent to ensure you have the right coverage for your specific situation. Don't forget to share this article with friends and family who may benefit from this information. For more insights into car insurance and other financial topics, explore our other articles on the website.

Table of Contents

- What is State Farm Comprehensive Coverage?

- Why Choose State Farm Comprehensive Coverage?

- How Does State Farm Comprehensive Coverage Work?

- State Farm Comprehensive Coverage Costs and Factors

- State Farm Comprehensive Coverage vs. Collision Coverage

- Limitations of State Farm Comprehensive Coverage

- How to File a State Farm Comprehensive Coverage Claim

- State Farm Comprehensive Coverage and Natural Disasters

- Tips for Maximizing State Farm Comprehensive Coverage

- State Farm Comprehensive Coverage: Frequently Asked Questions